Microsoft Dynamics 365 Life Insurance

In today’s economy, insurance organizations face a growing number of challenges, including an ongoing economic slowdown, more stringent regulatory compliance requirements, and increased competition for fewer new sales. Microsoft Dynamics CRM & Dynamics 365 can help organizations meet these challenges by extending the core CRM with tailored new functionality that helps insurance organizations drive organic growth, provide an integrated 360-degree view and facilitate real-time collaboration across the sales team.

Microsoft Dynamics 365 is CRM (Customer Relationship Management), a category of integrated, data-driven solutions that improve how you interact and do business with your customers. CRM systems and applications are designed to manage and maintain customer relationships, track engagements, and sales, and deliver actionable data – all in one place.

- Drive organic growth with 360° Client View

- Facilitate real-time collaboration across the sales

- Get Policy and Claims Management

- Improve communications inside and outside

- Store and manage all information about your customers, employees, partners, shareholders, etc.

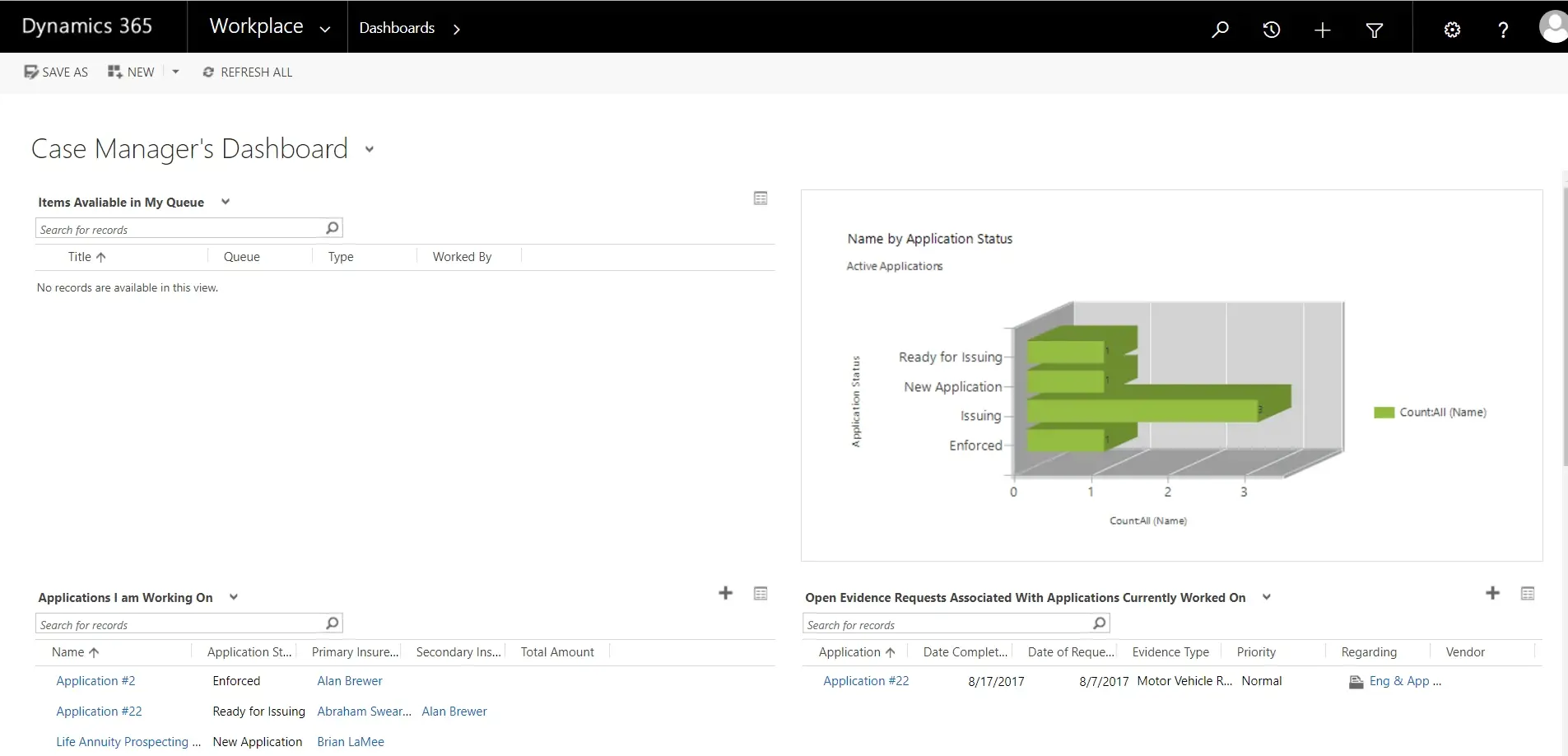

- Get a variety of pre-built and customized dashboards for Insurance Agents, Case Managers, Underwriters, Issuing Team and more

- Get access from any internet connection via laptop, tablet, or mobile

- Run system in Cloud to reduce IT costs and maximize system uptime

- Integrate with other Microsoft products (Excel, Word, Skype, PowerPoint, SharePoint, Yammer, etc.).

In this demonstration, you’ll see the benefits of Dynamics 365 for Life Insurance Sales from the point of view of an Insurance Agent, Case Manager, Underwriter, and member of the Issuing team. This article describes only one of the cases of how Microsoft Dynamics 365 can help Life Insurance Agencies. Among all out-of-the-box Microsoft Dynamics 365 capabilities (more info here), it can be tailored to meet your business needs and your vision of the system (since it’s very flexible). Please contact us if you want to know more about the solution.

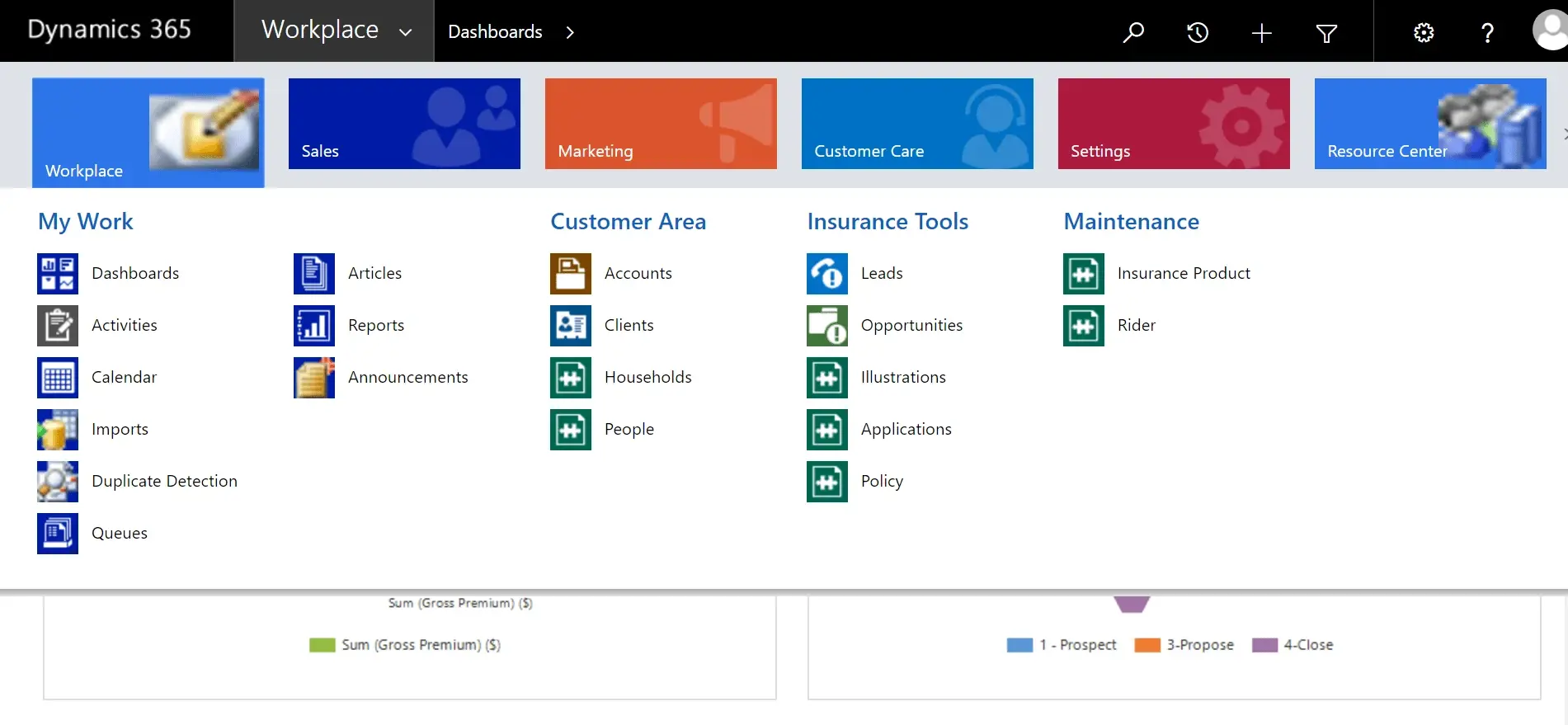

Let’s start with the Navigation Menu in MS Dynamics 365 Life Insurance. System navigation consists of Sales, Marketing, Service, Settings, and Resource center tabs (read more about Dynamics 365 out-of-box capabilities here). It differs from standard out-of-the-box systems with this “Workplace” tab and its content.

Insurance Agent

Insurance Agent uses this dashboard to quickly review the health of the sales pipeline, the status of opportunities in the sales cycle, and key work items that need their attention.

Insurance Agent wants to focus on upselling a new annuity insurance product to a select group of customers.

With Advanced Search Tools in Microsoft Dynamics 365 agent can generate a list of highly qualified clients based on specific criteria.

This list can be saved for future use or to create a Quick Campaign.

The Quick Campaign assigns prospecting activities to members of the sales team for each record. Insurance Agent performs a call and uses Microsoft Dynamics 365 to record notes about the conversation

If the prospect would like to learn more about the annuity product, Insurance Agent can convert the record to an opportunity and schedule a follow-up appointment. Once Insurance Agent has completed the prospecting call, he has a qualified list of clients to begin meeting with.

If the client is interested in seeing illustrations of the new annuity product agent goes to the Activity panel and finds the task about Illustrations, and marks it “complete”.

Once Insurance Agent submits the illustration, the insurance template converts it to an application for a Case Manager to review.

Case Manager

Now let’s look at the experience of a Case Manager, who uses the insurance template for Microsoft Dynamics 365 to monitor the case management queue for incoming applications.

The Case Manager sees the application Insurance Agent submitted and reviews the application for any missing information. With the issue resolved Case Manager submits the application to an Insurance Underwriter to quickly evaluate and rate new policies.

Insurance Underwriter

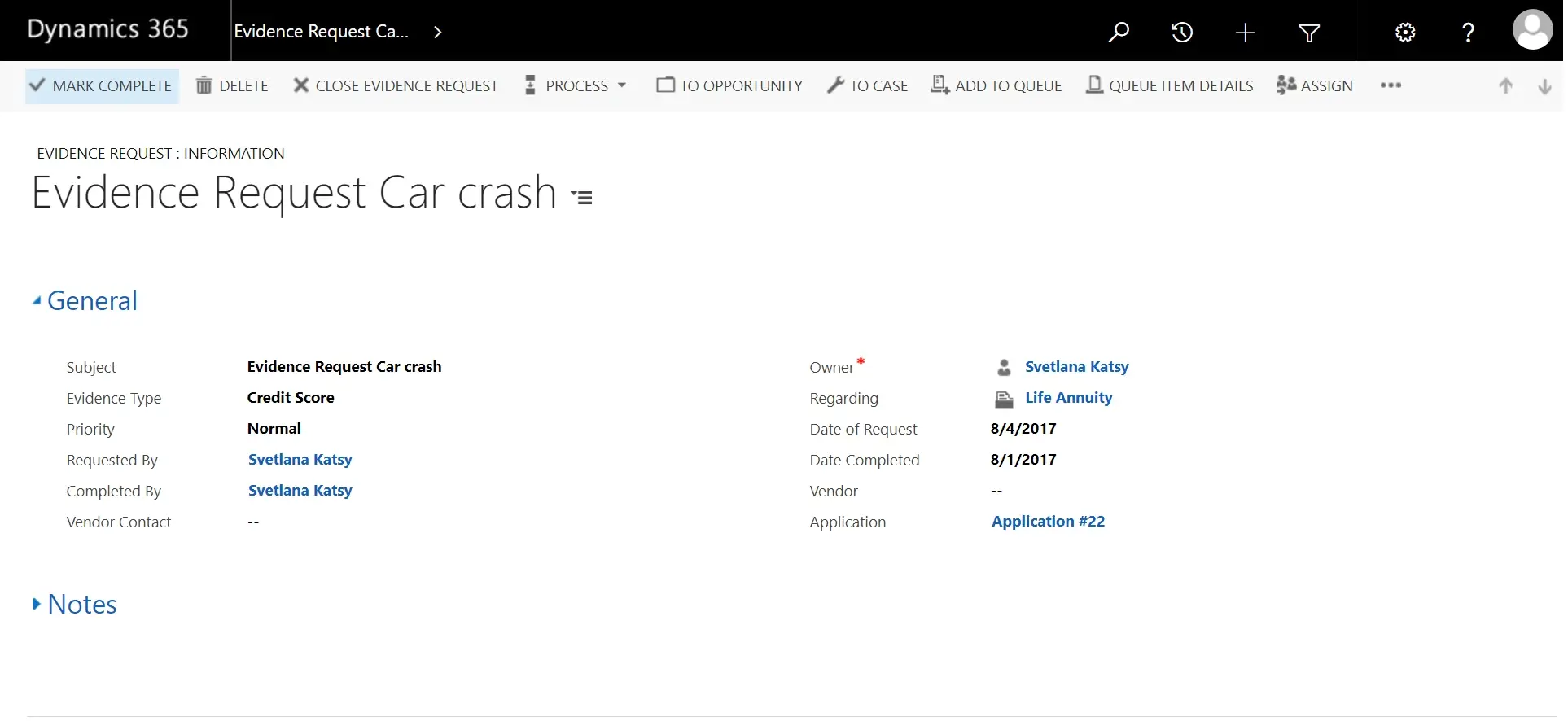

Insurance Underwriter’s Dashboard is similar to Case Manager’s Dashboard, except that it has activities specified for Underwriter’s Team. Insurance Underwriter monitors the underwriting queue for new policy and begins to evaluate it, which entails creating, reviewing and completing evidence requests, associated with the policy.

As evidence is collected, Insurance Underwriter marks evidence requests as “Complete” and has the option of uploading any updated documents to the SharePoint library.

Insurance Underwriter rates the application sending it to the Issuing team’s queue so that it can be prepared for client review.

Issuing Team

Microsoft Dynamics 365 helps a member of the Issuing Team efficiently issue and enforce new policies. Once the new policy has been reviewed and approved by the client member of the Issuing Team receives a signed copy along with the initial payment and updated status of the application.

UDS Systems' extensive experience has allowed delivering sector-specific functionality for Life Insurance Sales. The high flexibility of Microsoft Dynamics 365 & Microsoft Dynamics CRM allows for tailoring the system to suit each customer’s needs and implementing solutions effectively and safely. Please feel free to contact us if you have questions about this subject.

Note: UDS Systems provides high-quality Microsoft Dynamics CRM & Dynamics 365 solutions, starting from CRM Online Customization and up to long-term On-Premise Projects with Agile methodology, industry modifications, and multiple system integrations for EU, AU, and US-based companies.